New Prepaid Rule

By: Bill Elliott, CRCM, Senior Consultant and Manager of Compliance

On October 5, 2016, the CFPB issued a final rule amending Regulations E and Z to create comprehensive consumer protections for prepaid financial products. The result of this rule is that many of you may not continue to offer these accounts, and those of you who do not currently offer the accounts may not want to start. The purpose of this article is not to talk you into or out of these products, but to give you the basic facts so that you can make the best decision for your institution.

The Prepaid Rule runs 1,501 pages, so we can only do an overview in this article. You may also want to look at the following: http://www.consumerfinance.gov/policy-compliance/guidance/implementation-guidance/prepaid

Another site worth your time might be: http://www.consumerfinance.gov/policy-compliance/rulemaking/final-rules/prepaid-accounts-under-electronic-fund-transfer-act-regulation-e-and-truth-lending-act-regulation-z/

Prepaid Accounts

The Prepaid Rule adds the term “prepaid account” to the definition of “account” in Regulation E. Payroll card accounts and government benefit accounts are prepaid accounts under the Prepaid Rule’s definition. Additionally, a prepaid account includes a product that is either of the following, unless a specific exclusion in the Prepaid Rule applies:

- An account that is marketed or labeled as “prepaid” and is redeemable upon presentation at multiple, unaffiliated merchants for goods and services or usable at automated teller machines (ATMs); or

- An account that meets all of the following:

- Is issued on a prepaid basis in a specified amount or is capable of being loaded with funds after issuance

- Whose primary function is to conduct transactions with multiple, unaffiliated merchants for goods or services, to conduct transactions at ATMs, or to conduct person-to-person (P2P) transfers

- Is not a checking account, a share draft account, or a negotiable order of withdrawal (NOW) account

There are exceptions to the rule. Under the existing definition of account in Regulation E, an account is subject to Regulation E if it is established primarily for a personal, household, or family purpose. Therefore, an account established for a commercial purpose is not a prepaid account.

Pre-Acquisition Disclosures

The Prepaid Rule contains pre-acquisition disclosure requirements for prepaid accounts. The requirements are detailed. However, there often will be a reseller of these products, meaning that the seller must prepare this disclosure for you. This “short form” disclosure includes general information about the account.

Outside but in close proximity to the short form disclosure, a financial institution must disclose its name, the name of the prepaid account program, any purchase price for the prepaid account, and any fee for activating the prepaid account.

There is also a long form disclosure which sets forth comprehensive fee information as well as certain other key information about the prepaid account.

The Prepaid Rule includes a sample form for the long form disclosure. The long form disclosure must include a long laundry list of items that details every nook and cranny of the account’s use. The Prepaid Rule also requires financial institutions to make disclosures on the access device for the prepaid account, such as a card. If the financial institution

does not provide a physical access device for the prepaid account, it must include these disclosures on the website, mobile application, or other entry point the consumer uses to electronically access the prepaid account.

All these disclosures are in addition to your standard Regulation E initial disclosure. The initial disclosures must include all of the information required to be disclosed in the pre-acquisition long form disclosure.

Error Resolution and Limitations on Liability

Prepaid accounts must comply with Regulation E’s limited liability and error resolution requirements, with some modifications. This may or may not be your problem, depending on who owns the account. But if your third-party vendor must give the customer these rights, the cost will likely go up, possibly making selling these cards a problem.

Periodic Statements and the Periodic Statement Alternative

The Prepaid Rule requires financial institutions to provide periodic statements for prepaid accounts, such as payroll accounts. However, a financial institution is not required to provide periodic statements for a prepaid account if it makes certain information available to a consumer, such as:

- Account balance information by telephone

- Electronic account transaction histories for the last 12 months

- Written account transaction histories for the last 24 months

Overdraft Credit Features

The Prepaid Rule amends Regulations E and Z to regulate overdraft credit features that are offered in connection with prepaid accounts. It adds the term “hybrid prepaid credit card” to Regulation Z and sets forth specific requirements

that apply to hybrid prepaid-credit cards. Doing something like this will materially increase your costs. Of course, there are many more rules on the subject that we cannot include in this article.

Effective Dates

The Prepaid Rule is generally effective on October 1, 2017.

What Should You Do?

Over the next few months, you need to talk with any existing companies that you do business with for this kind of product. They may still be struggling with how they are going to approach this, so you may not get all your answers immediately. But you need to know what your role is going to be after October 1, 2017 so that you can make the best decision for your institution. And all new product offerings, whether internal or external, need to be examined carefully to make sure that you can comply with the rules.

For more information about this article, contact Bill Elliott at 1.800.525.9775

or compliance@younginc.com.

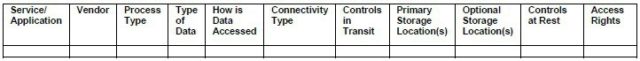

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.