CFPB Amends HMDA Rule

By: William J. Showalter, CRCM, CRP; Senior Consultant

The Consumer Financial Protection Bureau (CFPB) issued a final rule making several technical corrections and clarifications to the expanded data collection under Regulation C, which implements the Home Mortgage Disclosure Act (HMDA). The regulation is also being amended to temporarily raise the threshold at which banks are required to report data on home equity lines of credit (HELOC).

These amendments take effect on January 1, 2018, along with compliance for most other provisions of the newly expanded Regulation C.

Background

Since the mid-1970s, HMDA has provided the public and public officials with information about mortgage lending activity within communities by requiring financial institutions to collect, report, and disclose certain data about their mortgage activities. The Dodd-Frank Act amended HMDA, transferring rule-writing authority to the CFPB and expanding the scope of information that must be collected, reported, and disclosed under HMDA, among other changes.

In October 2015, the CFPB issued the 2015 HMDA Final Rule implementing the Dodd-Frank Act amendments to HMDA. The 2015 HMDA Final Rule modified the types of institutions and transactions subject to Regulation C, the types of data that institutions are required to collect, and the processes for reporting and disclosing the required data. In addition, the 2015 HMDA Final Rule established transactional thresholds that determine whether financial institutions are required to collect data on open-end lines of credit or closed-end mortgage loans.

The CFPB has identified a number of areas in which implementation of the 2015 HMDA Final Rule could be facilitated through clarifications, technical corrections, or minor changes. In April 2017, the agency published a notice of proposed rulemaking that would make certain amendments to Regulation C to address those areas. In addition, since issuing the 2015 HMDA Final Rule, the agency has heard concerns that the open-end threshold at 100 transactions is too low. In July 2017, the CFPB published a proposal to address the threshold for reporting open-end lines of credit. The agency is now publishing final amendments to Regulation C pursuant to the April and July HMDA proposals.

HELOC Threshold

Under the rule as originally written, banks originating more than 100 HELOCs would have been generally required to report under HMDA, but the final rule temporarily raises that threshold to 500 HELOCS for data collection in calendar years 2018 and 2019, allowing the CFPB time to assess whether to make the adjusted threshold permanent.

In addition, the final rule corrects a drafting error by clarifying both the open-end and closed-end thresholds so that only financial institutions that meet the threshold for two years in a row are required to collect data in the following calendar years. With these amendments, financial institutions that originated between 100 and 499 open-end lines of credit in either of the two preceding calendar years will not be required to begin collecting data on their open-end lending (HELOCs) before January 1, 2020.

Technical Amendments and Clarifications

The final rule establishes transition rules for two data points – loan purpose and the unique identifier for the loan originator. The transition rules require, in the case of loan purpose, or permit, in the case of the unique identifier for the loan originator, financial institutions to report “not applicable” for these data points when reporting certain loans that they purchased and that were originated before certain regulatory requirements took effect. The final rule also makes additional amendments to clarify certain key terms, such as “multifamily dwelling,” “temporary financing,” and “automated underwriting system.” It also creates a new reporting exception for certain transactions associated with New York State consolidation, extension, and modification agreements.

In addition, the 2017 HMDA Final Rule facilitates reporting the census tract of the property securing or, in the case of an application, proposed to secure a covered loan that is required to be reported by Regulation C. The CFPB plans to make available on its website a geocoding tool that financial institutions may use to identify the census tract in which a property is located. The final rule establishes that a financial institution would not violate Regulation C by reporting an incorrect census tract for a particular property if the financial institution obtained the incorrect census tract number from the geocoding tool on the agency’s website, provided that the financial institution entered an accurate property address into the tool and the tool returned a census tract for the address entered.

Finally, the final rule also makes certain technical corrections. These technical corrections include, for example, a change to the calculation of the check digit and replacement of the word “income” with the correct word “age” in one comment.

The HMDA final rule is available at www.consumerfinance.gov/policy-compliance/rulemaking/final-rules/regulation-c-home-mortgage-disclosure-act/.

Updated HMDA Resources

The CFPB also has updated its website to include resources for financial institutions required to file HMDA data. The updated resources include filing instruction guides for HMDA data collected in 2017 and 2018, and HMDA loan scenarios. They are available at www.consumerfinance.gov/data-research/hmda/for-filers.

For More Information

For more information on this article, contact Bill Showalter at 330-422-3473 or

wshowalter@younginc.com.

For information about Young & Associates, Inc.’s newly updated HMDA Reporting

policy, click here. In addition, we are currently updating our HMDA Toolkit.

To be notified when the HMDA Toolkit is available for purchase, contact Bryan

Fetty at bfetty@younginc.com.

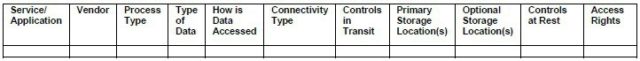

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.