Capital Market Commentary – May 2017

By: Stephen Clinton, President, Capital Market Securities, Inc.

Market Update – The Trump Effect

The election of President Donald Trump was followed by a strong upward movement in the market. Hopes related to lower taxes, less regulation, and economic stimulus led the market to new highs. Since the election, the Dow Jones Industrial Average moved up 14.22% through April 30th. Banks moved upward even more, increasing 21.29% (as measured by the Nasdaq Bank Index). Much has been made of the first 100 days of the new administration, with many Executive Orders being issued but no real legislative actions accomplished. The March failure to pass legislation to repeal the Affordable Care Act was a stark reminder that enacting legislation is a difficult process. However, the market appears to remain optimistic that President Trump’s initiatives will be delivered.

Economic Developments of Note

- April marks the 94th month for the current economic expansion, the third longest in U.S. history (1960’s and 1990’s were the two longest).

- The U.S. economy grew at its weakest pace in three years in the first quarter as consumer spending barely increased and businesses invested less on inventories. Gross domestic product increased at a 0.7% annual rate, the weakest performance since the first quarter of 2014. The economy grew at a 2.1% pace in the fourth quarter of 2016.

- The latest annual inflation rate for the United States is 2.1%, exceeding the Fed’s target of 2% for the first time in nearly five years. The increase in inflation may provide support for the Fed to continue its plans to move interest rates up in 2017.

- In March, it was reported that employers slowed their pace of hiring. However, unemployment was reported at 4.5%. The March unemployment rate was the lowest in almost a decade. It was also reported that private-sector workers saw average earnings rise 2.7% in March compared to the previous year. This is a sign that we are nearing “full employment” and competition is heating up to attract and retain employees.

- Activity in the manufacturing sector remained solid in April marking the eighth consecutive month of industrial expansion. One concern for the future, however, is the auto industry. After seven straight years of sales gains, including two consecutive record performances, auto demand has cooled in 2017 despite soaring discounts. Overall, auto makers sold 1.43 million vehicles in the U.S. in April, down 4.7% from a year earlier. A record 17.55 million vehicles were sold in 2016.

- Exports were reported to be higher by 7.2% this year. This is a positive sign to future economic growth.

- Home prices have continued their impressive climb upward. The S&P/Case-Shiller Home Price Index, covering the entire nation, rose 7% in the 12 months ending in February. We anticipate that these gains will continue, perhaps at a slower rate, due to high demand, low inventories, as well as the overall positive financial condition of home buyers.

We expect that the economy will remain on a positive trend this year. We project GNP to be at 2% for the year as a whole. Job growth should remain positive this year. We expect home building and home sales to be positive. We think that the Fed will increase rates, but anticipate them to be cautious in how quickly they raise rates and reduce their holdings of securities.

Interesting Tid Bits

- It has been reported that several large auto lenders have decreased their emphasis on auto lending due to concerns about credit quality issues and auto resale values. A portion of this concern is related to the length of new car loans being made. Loans with original terms of between 73 and 84 months accounted for 18.2% of the market. It was further reported that 31% of consumers who traded in a car in 2016 did so in a negative equity position.

- China’s banking system was reported as the largest by assets, reaching $33 trillion at the end of 2016. This compares to $16 trillion for the U.S. banking market.

- U.S. household net worth was reported at a record $92.8 trillion at year-end 2016. U.S. households lost approximately $13 trillion during the 2007-2009 recession. The eight-year rally since has added $38 trillion in net worth principally from rising stock prices and climbing real estate values.

- The Farm Credit System (a government sponsored enterprise) has over $314 billion in assets which would place it as one of the country’s ten largest banks.

- A bankruptcy judge recently issued a $45 million fine against Bank of America. The action was in connection with a $590,000 residential mortgage loan and servicing issues related to its delinquency.

- We have been led to believe that small businesses employ the majority of Americans. This is no longer the case. Large companies (10,000 employees or more) employ over 25% of the workforce. Employers with more than 2,500 workers employ 65% of total employees.

- Nonbank lenders (i.e., Quicken Loans) were responsible for 51.4% of the consumer mortgage loans originated in the third quarter of 2016. This is up from 9% in 2009.

- People in the United States ages 65 to 74 hold more than five times the debt Americans held two decades ago.

Short-term interest rates ended April 30 up 29 b.p. from year-end with the 3-Month T-Bill at 0.80%. The 10-Year T-Note ended April at 2.29%. This is lower than December 31, 2016, when they were at 2.45%. This reflects a flattening of the yield curve.

The general stock market continued to climb to record levels in the first four months of 2017. The Dow Jones Industrial Index ended April up 5.96% for the year. Banks, after their spectacular rise after the election, retreated somewhat in the first four months of 2017. The broad Nasdaq Bank Index fell 4.05%. Larger banks were more fortunate (as measured by the KBW Bank Index) falling only 0.60%. Banks appear to have been more impacted by the uncertainty surrounding proposed tax cuts and less regulation than other companies.

Merger and Acquisition Activity

For the first four months of 2017, there were 77 bank and thrift announced merger transactions. This compares to 83 deals in the same period of 2016. The median price to tangible book for transactions involving bank sellers was 159% compared to the 133% median value for all of 2016.

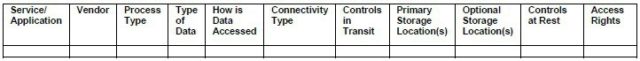

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.

Here’s a way this could be used to illustrate the way that an institution can document data flow and data storage. You will first identify each Service or Application that uses NPI. Some examples of these services and applications include: core processing, lending platform, internet banking, and online loan applications. Next, you will identify the Vendor(s) associated with each service or application. The Process Type is used to identify the various processes that are performed using the specific service or application that may use different methods for accessing the data or result in data being transmitted through different connectivity types. An example of different process types can be illustrated with internet banking where data may flow between the core processing system and the internet banking system through a dedicated circuit, but customers access the internet banking system through a home internet connection. The Type of Data will most often be customer NPI, but may also include proprietary institution data. Data can be accessed in numerous ways including: institution workstations, institution servers, employee mobile devices, customer PCs, and customer mobile devices. The Connectivity Type may include: dedicated circuits, virtual private networks (VPN), local area networks (LAN), wide area networks (WAN), wireless networks, or the internet. Controls in Transit may include: encryption, firewall rules, patch management, and intrusion prevention systems (IPS). The Primary Storage Location(s) should include known locations where the data is stored such as: application or database servers, data backup devices, service provider datacenters, and service provider backup locations. The Optional Storage Location(s) should consider other places where data can be stored such as: removable media, an employee’s workstation, mobile devices, Dropbox, and Google Drive. Identifying the Optional Storage Location(s) may take a significant amount of time, as this step will involve discussions with application administrators to understand the options for exporting data and discussions with employees to understand their processes for transferring and storing data. A review of this information may lead to the implementation of additional controls to block the use of unapproved sharing and storage services.