The importance of appraisal reviews in protecting financial institutions

By Casey Simpson; consultant and manager of appraisal review services, Young & Associates

In the real estate industry, accurate and unbiased property appraisals are critical. These influence lending decisions, investment strategies, tax assessments and legal outcomes. Appraisal reviews are a safeguard for financial institutions, investors and the public. Additionally, the regulators outlined this process as a requirement.

Accurate and unbiased property appraisals drive critical decisions in lending, investment strategies, tax assessments and legal outcomes. Appraisal reviews provide safeguards for financial institutions, investors and the public, and regulators mandate the process.

Although appraisal value thresholds have changed over time, the obligation to review appraisals has not. Financial institutions must still conduct a review whenever an appraisal supports a transaction.

The Interagency Appraisal and Evaluation Guidelines from 2010 specifically states, “As part of the credit approval process and prior to a final credit decision, an institution should review appraisals and evaluations to ensure that they comply with the Agencies’ appraisal regulations and are consistent with supervisory guidance and its own internal policies. This review also should ensure that an appraisal or evaluation contains sufficient information and analysis to support the decision to engage in the transaction.”

What are real estate appraisal reviews?

A real estate appraisal review evaluates an appraisal report for completeness, accuracy, consistency and compliance with applicable standards.

Qualified professionals who are independent from the subject transaction and have experience in the relevant property type should perform appraisal reviews to maximize the benefits. Use consistent review checklists with a clear understanding of the client’s scope of work. Align with client-specific requirements and regulatory compliance. Provide a detailed narrative of the transaction appraisal that documents findings and highlights deficiencies or recommendations.

Key benefits of real estate appraisal reviews

- Enhances accuracy and reliability: Errors, omissions, or flawed assumptions in an appraisal can result in inaccurate valuations. A review identifies discrepancies and unsupported conclusions to ensure the final report is accurate and defensible.

- Mitigates financial risk: For lenders and investors, misvalued properties carry significant risks. Reviews serve as a risk.

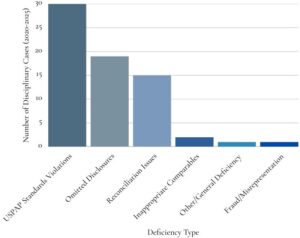

- Ensures regulatory and standards compliance: Financial institutions are subject to strict regulatory requirements, including the Uniform Standards of Professional Appraisal Practice (USPAP), the Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA) and the Dodd-Frank Wall Street Reform and Consumer Protection Act. Appraisal reviews help ensure compliance with these requirements, protecting the institution from legal or regulatory penalties.

- Improves consistency across valuations: For organizations managing multiple appraisals, reviews promote consistency in methodology, terminology and value conclusions. This supports transparency and establishes quality standards.

- Cost limitations: Financial institutions with qualified in-house reviewers can use them as a resource to reduce risk. However, third-party providers can provide review services, with costs passed on to the customer as a line item on the closing settlement sheet.

Regulatory compliance explained

Uniform Standards of Professional Appraisal Practice (USPAP)

The purpose of USPAP is to promote and maintain a high level of public trust in appraisal practice by establishing requirements for appraisers. It sets forth standards for all types of appraisal services, including real property, personal property, business, appraisal review and mass appraisal. It is essential that appraisers develop and communicate their analyses, opinions and conclusions to intended users in a manner that is meaningful and not misleading. (source: www.appraisalfoundation.org and www.appraisers.org)

The Dodd-Frank Wall Street Reform and Consumer Protection Act

Commonly known as Dodd-Frank, it is legislation that was passed by the U.S. Congress in response to financial industry behavior that led to the financial crisis of 2007–2008. It sought to make the U.S. financial system safer for consumers and taxpayers. It established a number of new government agencies tasked with overseeing the various components of the law and, by extension, various aspects of the financial system. The Dodd Frank Act aimed to protect the independence of appraisers, reasonable and customary appraisal fees, appraiser certification and education standards, requirements for Appraisal Management Companies (AMC’s), standards for Automated Valuation Models (AVMs) and Broker Price Opinions (BPOs), additional provisions for high-risk mortgages, among other issues. (source: www.investopedia.com by Adam Hayes updated February 01,2025 and Regulatory Issues Facing the Real Estate Appraisal Profession)

Financial Institutions Reform, Recovery, and Enforcement Act of 1989 (FIRREA)

FIRREA has reshaped lending practices, particularly in real estate and mortgage financing. Lenders must adopt rigorous underwriting standards to ensure loans are extended to creditworthy borrowers, reducing the risk of defaults and enhancing financial system stability. Certified appraisals are now required to ensure accurate property valuations, critical for mitigating systemic risk in mortgage-backed securities. (source: www.accountinginsights.org Published Feb 13, 2025 and Regulatory Issues Facing the Real Estate Appraisal Profession)

Financial institutions face heightened risk if appraisals are not thoroughly reviewed. Independent reviews reduce risk, ensure adherence to standards and save valuable staff time. At Young & Associates, we provide independent appraisal reviews that give your team confidence in lending decisions while reducing compliance burdens. Let Young & Associates help you navigate appraisal compliance with confidence and efficiency. Reach out for a consultation.