By: Gary J. Young, President & CEO

The Mantra

As community bankers, we have all heard the mantra to increase capital. This is heard by the banker who has an 8% leverage ratio and needs to increase capital to 9%, by the banker who has a 9% leverage ratio and needs to increase capital to 10%, and by the banker who has a 10% leverage ratio and needs to increase capital to 11%. Based on this view regarding capital, more is always better. I disagree.

Capital Adequacy

I agree with the OCC. Capital adequacy at each bank is uniquely based on the current and planned risk within the bank. And, it is the responsibility of the bank board to determine capital adequacy with the input from executive management. Capital adequacy is the point at which a capital contingency plan is implemented if actual capital falls below that point. In other words, let’s assume capital adequacy has been defined as a 7.5% leverage ratio, or a 11.25% total risk-based ratio. If actual capital falls below either measure, the bank should implement the methodology for improving capital as described in the capital contingency plan.

Capital Target

A bank’s target or goal for capital is higher than capital adequacy. It is an estimate of the amount the board of directors has decided is desired to take advantage of opportunities such as additional organic growth, branch expansion, purchase of a bank or branch, stock repurchase, etc.; or to use as additional insurance or protection against negative events that could hurt profitability and capital. As an example, a 7.5% leverage ratio could be defined as capital adequacy, but the target level of capital is 9.0%.

Cost

Excess capital has a cost. Let’s assume you had to eliminate $1 million of excess capital. To balance that transaction, you would also eliminate $1 million in assets which would be investments. Let’s assume that the investments had an average yield of 1.5%. After taxes, that would be approximately 1.0%. Based on this example, the return on equity of the $1 million of excess capital is 1.0%. We must agree that 1.0% is unacceptable. Well, it is unacceptable unless that is your return for opportunity capital or insurance capital as described above.

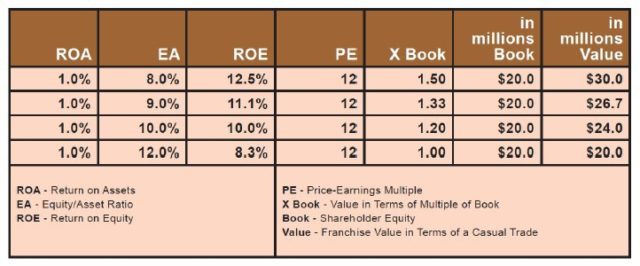

Another example of the cost of excess capital can be seen here. There are four banks with a 1% ROA. However, the equity/asset ratio at each is different, ranging from an 8.0% leverage ratio to a 12.0% leverage ratio. By dividing the ROA by the leverage ratio, you get the ROE. By multiplying the ROE by an assumed PE, you get the multiple of book. In this example, the bank with an 8.0% leverage ratio has a value of $30 million while the bank with a 12.0% leverage ratio has a value of $20 million. This is a simplified example that provides information on the cost of excess capital.

Another example of the cost of excess capital can be seen here. There are four banks with a 1% ROA. However, the equity/asset ratio at each is different, ranging from an 8.0% leverage ratio to a 12.0% leverage ratio. By dividing the ROA by the leverage ratio, you get the ROE. By multiplying the ROE by an assumed PE, you get the multiple of book. In this example, the bank with an 8.0% leverage ratio has a value of $30 million while the bank with a 12.0% leverage ratio has a value of $20 million. This is a simplified example that provides information on the cost of excess capital.

The Right Amount

There is no right amount. The average less than $1 billion bank has a 10.8% leverage ratio and a 16.6% total risk-based capital ratio. Most everyone would agree that banks do not need that level of capital. But, every bank is unique with different levels of risk and different levels of risk appetite. The important thing is that executive management and the board of directors understand that there is a shareholder cost to holding excess capital.

That doesn’t make it wrong. The board of directors has multiple responsibilities and at times they can be conflicting. From the shareholder perspective, you want to maximize the return on equity and shareholder value which assumes leveraging capital, but you must also oversee the operation of a safe and sound bank. And, at the heart of safety is capital adequacy. It takes balance and awareness of both to determine the right level of capital for the bank. My concern is that through the Great Recession and after, the capital mantra has been “more is better.” Well frankly, more is not necessarily better. I am suggesting that it is time to balance the capital need for risk management with the capital need for improving shareholder value.

Best Practices

The question for executive management is what should I do? It is my opinion that best practices would indicate that every bank develop a definition of capital adequacy based on inherent risk. Furthermore, a capital contingency plan should be part of that plan that indicates the steps the bank might take if capital falls below or is projected to fall below your definition of capital adequacy. You should then have a frank discussion at the board level on the amount of capital that is your goal or comfort level. If you then find that your capital is above that, consider the following:

- Focus on additional organic growth, if possible.

- Expansion opportunities. I would suggest looking for opportunities that begin turning a profit in two years or less.

- A stock repurchase plan. This is a win for the shareholders that want to sell and the shareholders that want to hold. Everyone wins and shareholder value should increase.

- A slow, steady increase in dividends to shareholders.

Consider how all of these items might impact your capital adequacy, return on equity, and shareholder value over a 3-5 year period. Remember, the goal of executive management is to maximize profitability and shareholder value within capital guidelines approved by your board of directors.

For More Information

If you would like to discuss this article with me, you can contact me 1.800.525.9775 or click here to send an email.