Do I have to be a GENIUS to understand Stablecoin?

By Michael Gerbick; president, Young & Associates

In July 2025, the GENIUS Act was signed into law. With it came comprehensive regulatory guardrails for stablecoins and stablecoin providers. The law’s passage drew widespread attention from financial institutions. If you find yourself asking, ‘How does stablecoin apply to my community bank?’ You are not alone. Many of our customers are learning how stablecoin might apply to them, while others have already become issuers.

Additional questions being asked include:

- How does it impact me and my bank?

- Where is the value for us to enter this space?

- My customers aren’t transacting internationally. Is this still something I should consider?

Demystifying stablecoin

Cryptocurrency has been around for several years, but it’s still a new concept for many community banks. Institutions are continuing to learn how it fits within their operations and where it might create value for their customers. The goal of a stablecoin is to provide a means of payment within the digital asset ecosystem.

So what exactly is a stablecoin? It is a type of cryptocurrency that pegs its value to a real-world asset, often a traditional fiat currency like the U.S. dollar¹ (USD).

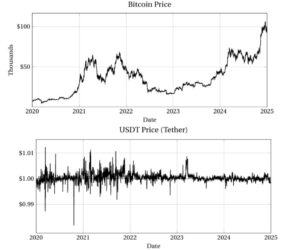

For example, one unit of a stablecoin that’s pegged to the USD should always be worth $1. Because its value is tied to a real-world asset like the USD, a stablecoin is generally less volatile than other cryptocurrencies, whose prices can fluctuate rapidly. See the chart below.

Here are a few factors to consider as you explore the potential value of engaging with digital assets at your institution:

- Fee income from issuing, serving as a custodian and facilitating other related transactions.

- Lower costs and faster processing for international transactions using stablecoin.

- Access to new markets.

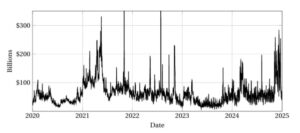

- Consider emerging businesses that prefer to leverage stablecoins and other cryptocurrencies. Although still small compared to traditional currency, total stablecoin transaction volume continues to grow, as shown in the chart below.

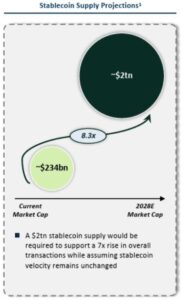

A publication from the Department of the U.S. Treasury in April 2025 lists a projection of stablecoin supply reaching $2 trillion in 2028 if velocity remains unchanged.

- Transaction speed. Stablecoins enable 24/7/365 settlement and near-instant payments, allowing transactions outside typical community banking hours.

- Reputation and trust. Banks are widely recognized as safe and secure because of their long history in a regulated environment and their transparent reporting practices. That trusted reputation can extend into the digital asset space as customers evaluate stablecoin issuers.

What community banks should consider

Of all the factors noted above, your institution’s reputation may be the most valuable reason to explore digital assets. Community banks are already trusted as being safe and secure with customers’ deposits and loans. Why not extend that trust into the stablecoin space and be seen as the reliable provider your community turns to?

Of all the factors noted above, your institution’s reputation may be the most valuable reason to explore digital assets. Community banks are already trusted as being safe and secure with customers’ deposits and loans. Why not extend that trust into the stablecoin space and be seen as the reliable provider your community turns to?

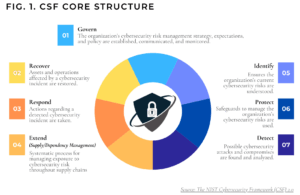

With value comes risk and there are many risks and challenges to consider when pursuing digital assets. Key areas to consider are BSA/AML, Liquidity, Operations and Technology, Evolving Regulatory Guidance, to name a few.

A recent FEDS Notes article discussed how increased stablecoin demand could affect bank deposits. The article explored the potential impact on traditional deposits and their levels, composition and concentration. The article largely focuses on the implications for deposit composition if demand for stablecoin increases substantially and stablecoin issuers continue to maintain their reserve assets as deposits. This could shift the bank concentration from insured retail deposits to uninsured wholesale deposits.

This shift has liquidity risk and funding costs implications. A change in composition would require adjustments to liquidity management and asset-liability matching due to the more volatile deposit base. Management of a new deposit mix may impact credit decisions related to loan size and duration. These challenges and consequences are highlighted to reinforce the potential impact on you and your community bank in the future, even if you choose not to pursue stablecoin. Please continue to monitor stablecoin adoption and consider how it may influence your community bank’s liquidity stress test scenarios, as they relate to deposits.

Final thoughts

As expected, some innovative community banks that are early adopters are issuing stablecoin and leveraging this currency to provide value to the communities they serve. They have a first-mover advantage, along with the implementation and ongoing management costs and risks that come with that advantage.

Ultimately, each community bank should evaluate the digital asset landscape regularly. It may not make sense to become a stablecoin issuer or custodian today — or even in the near future. However, ignoring the shift entirely is not the right move. Be curious. Ask questions of peers and partners. Stay informed.

Your competitors are learning, and so are your customers. From a relationship standpoint, there’s no better place to be than a trusted expert who understands what stablecoin is, its potential value, and how it can be leveraged to support your customers’ growing businesses. You don’t have to be a genius to see the opportunity.

How Y&A can help

With expertise in strategic planning, interest rate risk, liquidity, and capital planning, Michael helps financial institutions strengthen their financial position. Young & Associates can help your team implement proactive asset liability management strategies that not only meet regulatory expectations but also support long-term stability and growth.

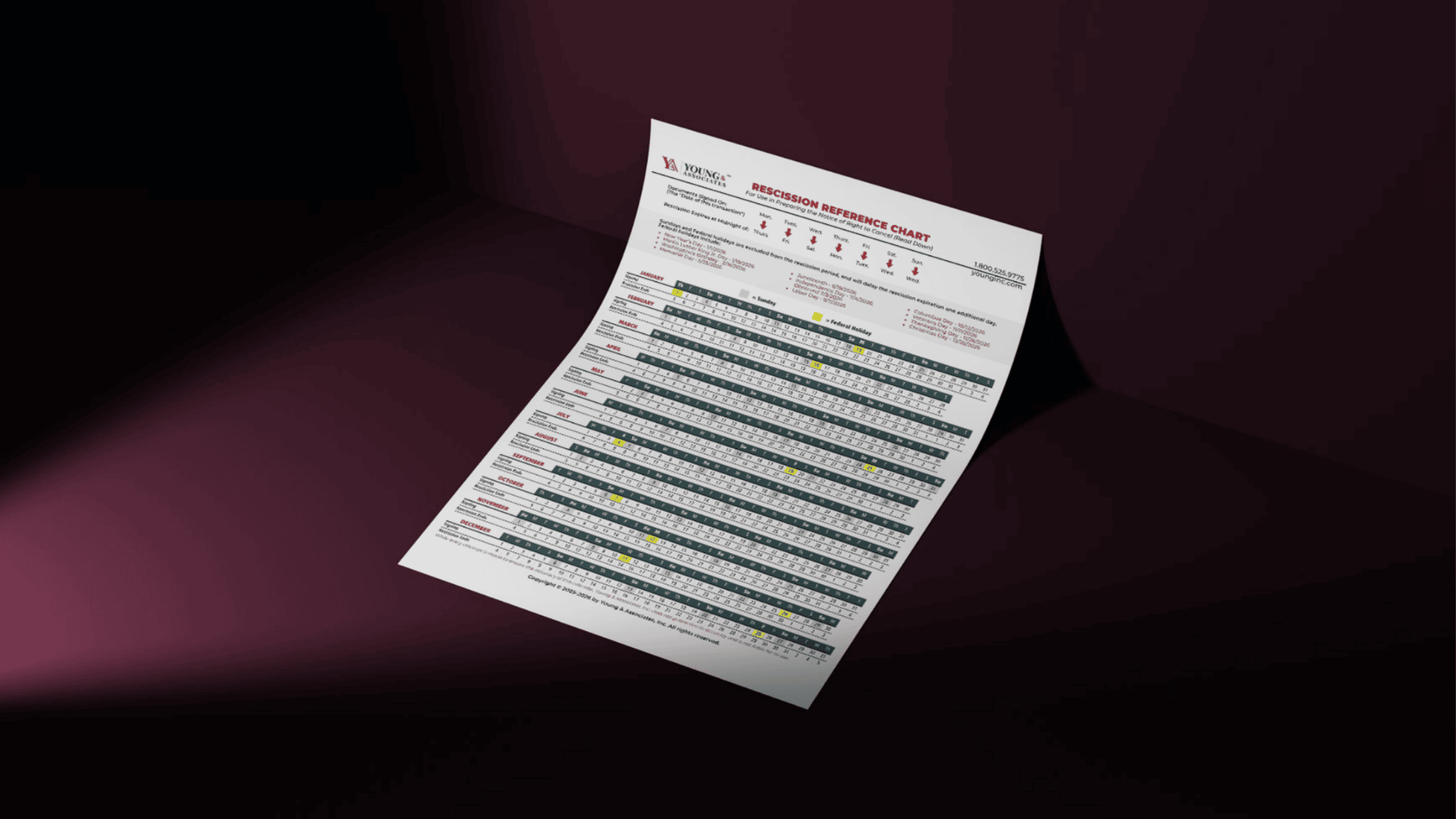

Below are a few tips on how to effectively communicate your concerns to the regulators.

Below are a few tips on how to effectively communicate your concerns to the regulators.